There's a reason MoneyWeek is Britain's best-selling financial magazine. We exist to help you ground your portfolio so that it keeps your money safe during rough patches and growing in the good times. We don't just look at how to maximise your returns and limit your losses, we also like to look at how you can keep more of the money you've made.

Week-in, week-out we'll guide you through the financial world as it changes, alerting you to all the opportunities to profit and dangers to avoid, as they appear. Income strategies, rising-star companies, the best funds and trusts, clever ways to preserve your wealth during market turmoil... you will get the best ideas from the sharpest financial minds and investing professionals in Britain.

From the editor-in-chief...

Hapless insider trade of the week

Good week for

Bad week for

How to jump-start your car collection • Get behind the wheel of an alternative investment

Central banks’ credibility is at stake

Emerging markets fall behind the developed world

Why the greenback is on the rise

Viewpoint

It’s time to buy British

European stocks break out of 23-year range

MoneyWeek’s comprehensive guide to this week’s share tips

A German view

IPO watch

City talk

J&J is doing the splits • The healthcare giant has become the latest conglomerate to hive off a business or divide into smaller units. Matthew Partridge reports

Johnson Matthey’s battery dies

Was COP26 a success? • More is being achieved to halt climate change than often meets the eye. Emily Hohler reports

Boris moves to shut down sleaze scandal

Belarus weaponises migrants • The EU is once again seeing a crisis at its borders. Matthew Partridge reports

Xi and Biden’s strained chinwag

Betting on politics

News

The way we live now: state-of-the-art machines learn to do our dirty work

The return of nuclear power • It was the future once – and now it seems it is again as governments look for ways to meet their net-zero targets. Simon Wilson reports

A vote of confidence in Brexit Britain • Shell and Unilever have upped sticks and moved to the UK. We should tempt more corporate giants in

Who’s getting what

Nice work if you can get it

Funds that fail in the real world • Many market-beating strategies could be an illusion caused by the constant search for new ways to sell funds

I wish I knew what smart beta was, but I’m too embarrassed to ask

Guru watch • Rob Arnott, founder and chairman, Research Affiliates

Debt funds can pay dividends • TwentyFour Asset Management’s two trusts are producing healthy payouts

Activist watch

Short positions... beware performance fees

Best of the financial columnists

Money talks

Seven climate-change myths

Americans feel flush and gloomy

How to be an effective leader

Does it matter who’s in power?

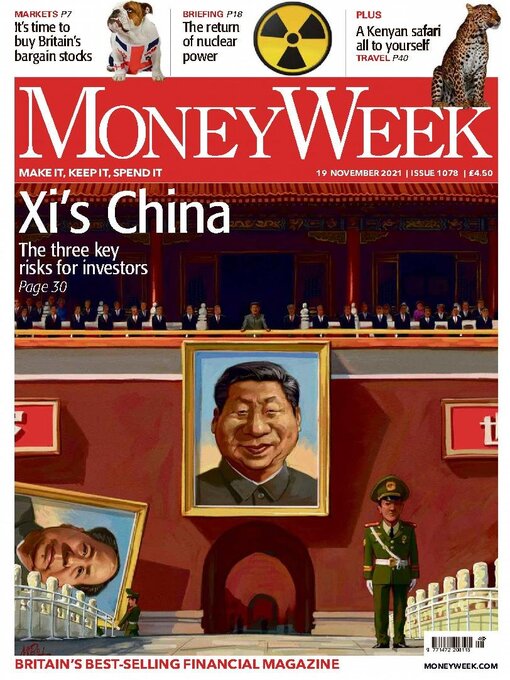

Investors should be cautious about Xi’s new era • The Chinese president’s vision for the future is very different to the past. Stricter social control and the slow struggle to tackle problems in the economy may not be good news for markets, says Cris Sholto Heaton

How to shift from growth to value in China

Is it time to remortgage? • Banks are already starting to prepare for higher interest rates

The minimum pension age • The rules relating to tapping retirement savings have been tweaked, but are still confusing

Look beyond the gloom to find the best of British • A professional investor tells us where he’d put his money. This week: Simon Murphy, manager of the VT Tyndall Real Income Fund, highlights three...

1259

1259

1258

1258

1257

1257

1256

1256

1255

1255

1254

1254

1253

1253

1252

1252

1251

1251

1250

1250

1249

1249

1248

1248

1246-1247

1246-1247

1245

1245

1244

1244

1243

1243

1242

1242

1240-1241

1240-1241

1239

1239

1238

1238

1237

1237

1236

1236

1235

1235

1234

1234